Internal Audit

內部稽核組織及運作

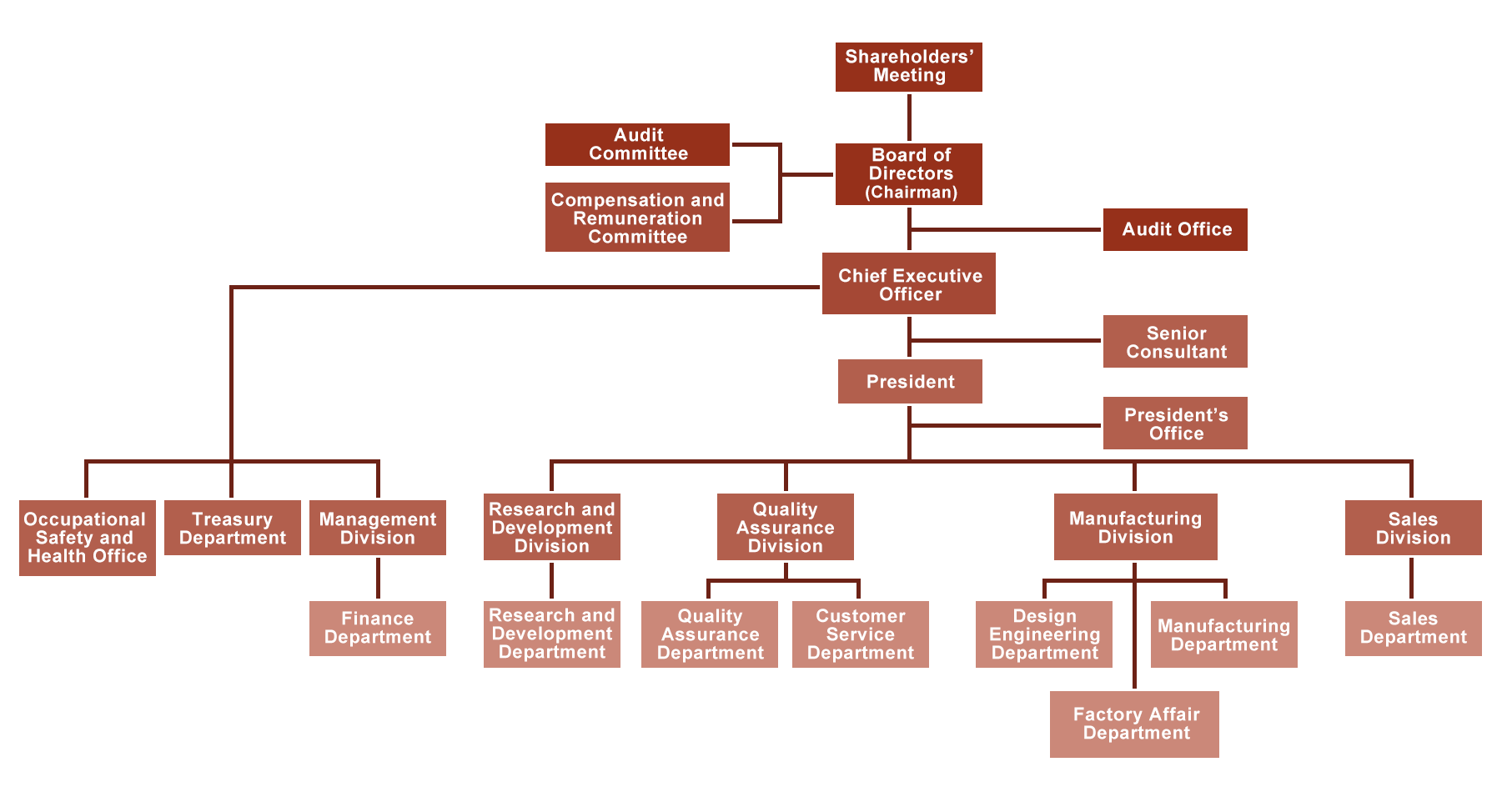

稽核室組織

*可點圖另開視窗放大觀看

Responsibilities and Operations of the Audit Department

The Audit Department operates under the jurisdiction of the Board of Directors and is staffed with one full-time auditor dedicated to internal audit work. This involves conducting both regular and ad-hoc financial and operational audits to examine and assess deficiencies in internal control systems, measure operational effectiveness and efficiency, and timely provide improvement suggestions to ensure the continuous and effective implementation of internal control systems. Additionally, the department assists the Board of Directors and management in fulfilling their responsibilities effectively.

I. Key Focus Areas of Audit Work:

- 1.Implementation, formulation, and execution of internal control systems in the company and its subsidiaries.

- 2.Establishment, revision, and execution of internal audit implementation guidelines in the company and its subsidiaries.

- 3.Formulation of an annual audit plan based on risk assessments, conducting audit operations, issuing audit reports, and tracking improvement in case of deficiencies.

- 4.Evaluation of various company policies, regulations, plans, and execution status, along with providing improvement recommendations.

- 5.Review of self-inspection reports from various departments and subsidiaries to serve as the basis for the Board of Directors and CEO to issue statements on internal control systems.

- 6.Regular reporting on audit operations to Independent Director and attending Board of Directors meetings.

- 7.Compliance with the 'Guidelines for Public Companies to Establish Internal Control Systems,' including relevant operational reporting deadlines:

• Submission of the "Internal Auditor Roster" for the current year by the end of January.

• Submission of the "Execution Status of Annual Audit Plan for the Previous Year" by the end of February.

• Submission of the "Statement on Internal Control Systems for the Previous Year" by the end of March.

• Submission of "Improvement Status of Internal Control System Deficiencies and Abnormalities for the Previous Year" by the end of May.

• Submission of the "Annual Audit Plan for the Next Year" by the end of December.

II. Annual Audit Plan:

- 1.Essential Audit Items:

Acquisition or disposal of assets, involvement in derivative transactions, fund lending, endorsing or providing guarantees to others, management of related party transactions, supervision and management of subsidiaries, management of Board of Directors' proceedings, operations of compensation committees, application of international accounting standards, accounting professional judgment processes, changes in accounting policies and estimates, information security checks, sales and collection cycles, procurement and payment cycles, and other critical transaction cycles. - 2.Formulating the annual audit plan items based on risk assessment results and conducting audits on each operational cycle to evaluate the soundness, reasonableness, and effectiveness of the company's internal control systems:

• Sales and collection cycles

• Procurement and payment cycles

• Production and research cycles

• Payroll cycles

• Fixed assets cycles

• Financing cycles

• Investment cycles

• Other cycles

• Computer operations

• Other management operations